Tax bracket calculator 2021

The next six levels are. A tax bracket is a category used to define your highest possible tax rate based on your filing status and taxable income.

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

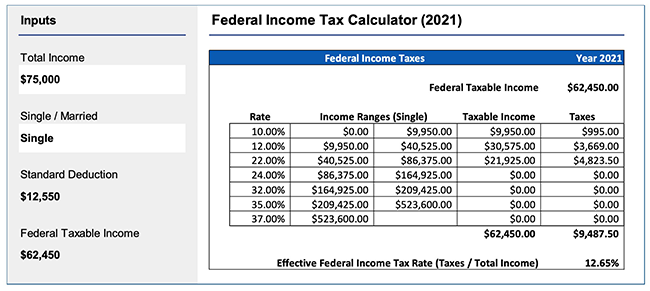

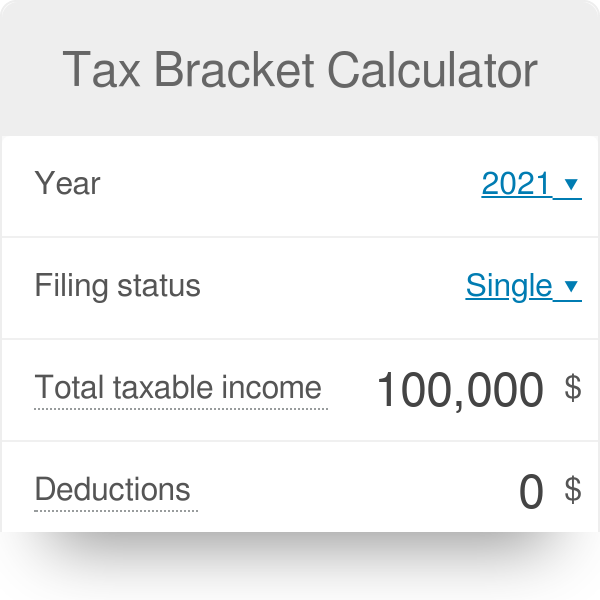

For Tax Year 2021 use the Tax Bracket Calculator below.

. There are seven federal tax brackets for the 2021 tax year. These are the rates for. And is based on the tax brackets of 2021 and.

Max refund is guaranteed and 100 accurate. Tax calculator is for 2021 tax year only. Calculate your income tax bracket 2021 2022.

Free tax calculator for simple and complex returns. There are seven federal tax brackets for the 2021 tax year. Guaranteed maximum tax refund.

Your bracket depends on your taxable income and filing status. It is mainly intended for residents of the US. This is 0 of your total income of 0.

We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. Ad Our Resources Can Help You Decide Between Taxable Vs. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

Your bracket depends on your taxable income and filing status. You can no longer e-File 2021 Tax Returns. Personal tax calculator.

2022 capital gains tax rates. The lowest tax bracket or the lowest income level is 0 to 9950. Explore 2021 tax brackets.

Its never been easier to calculate how much you may get back or owe with our tax estimator tool. Ad Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Calculate your 2021 tax.

0 would also be your average tax rate. Estimate your tax refund with HR Blocks free income tax calculator. Ad Build Your Future With a Firm that has 85 Years of Investment Experience.

The new 2018 tax brackets are. Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

For the current tax year use this Income Tax Calculator or RATEucator. Your tax bracket is. This calculator helps you to calculate the tax you owe on your taxable income for the full income year.

Find all 2021 tax. Do not use the calculator for 540 2EZ or prior tax. Your Federal taxes are estimated at 0.

It can be used for the 201314 to 202122 income years. Calculate your combined federal and provincial tax bill in each province and territory. In other words your income determines the bracket you will be.

The current tax rates 2017 consist of 10 15 25 28 33 35 and 396. Calculate the tax savings. TurboTax Online prices are determined at the time of print or electronic filing.

The current tax rates 2017 consist of 10 15 25 28 33 35 and 396. Calculate your income tax bracket 2021 2022 Filing Status Total Expected Gross Income For 2021 Show Advanced Options Calculate Your 2021 Income Tax Bracket. TurboTax experts are available from 9 am.

Ad Free means free and IRS e-file is included. As of 2016 there are a total of seven tax brackets. 10 12 22 24 32 35 and 37.

2021 capital gains tax calculator. Up to 10 cash back TaxActs free tax bracket calculator is a simple easy way to estimate your federal income tax bracket and total tax. All prices are subject to change without notice.

10 12 22 24 32 35 and 37. This BIR Tax Calculator helps you easily compute your income tax add up your monthly contributions and give you your total net monthly income. How to calculate Federal Tax based on your Annual Income.

It is taxed at 10 which means the first 9950 of the money you made that year is taxed at 10. Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Quickly figure your 2021 tax by entering your filing status and income.

The 2021 Tax Calculator uses the 2021 Federal Tax Tables and 2021 Federal Tax Tables you can view the latest tax tables and.

Excel Formula Income Tax Bracket Calculation Exceljet

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

Tax Calculator Refund Return Estimator 2021 2022 Turbotax Official

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Taxcaster Free Tax Calculator Estimate Your Tax Refund Turbotax Tax Refund Turbotax Tax

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

New Tax Regime Income Tax Slab For Ay 2021 22 For Individual Income Tax Income Tax

Income Tax Bracket Calculator Income Tax Brackets Tax Brackets Filing Taxes

Download Excel Based Income Tax Calculator For Fy 2020 21 Ay 2021 22 Financial Control Income Tax Income Tax

Click Here To View The Tax Calculations Income Tax Income Online Taxes

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Return

Income Tax Calculator For Fy 2019 20 Fy 2020 21 Eztax In Help

Inkwiry Federal Income Tax Brackets

Tax Bracket Calculator

Tax Calculator Estimate Your Income Tax For 2022 Free

Cash Flow Formula How To Calculate Cash Flow With Examples Cash Flow Positive Cash Flow Formula

Sales Tax Calculator