Roth 401k early withdrawal penalty calculator

Roth IRA withdrawal and penalty rules vary depending on your age and how long youve had the account and other factors. Participants in a traditional or Roth 401k plan are not allowed to withdraw their funds until they reach age 59½ with the exception of withdrawing funds to cover some.

How To Roll Over Your 401 K To An Ira Smartasset Saving For Retirement How To Plan 401k Plan

Roth IRA conversions require a 5-year holding period before earnings can be withdrawn tax free and subsequent conversions will require their own 5-year holding period.

. 401k Withdrawal Rules. You can avoid the early withdrawal penalty by waiting until at least age 59 12 to start taking distributions from your IRA. The main difference is the income.

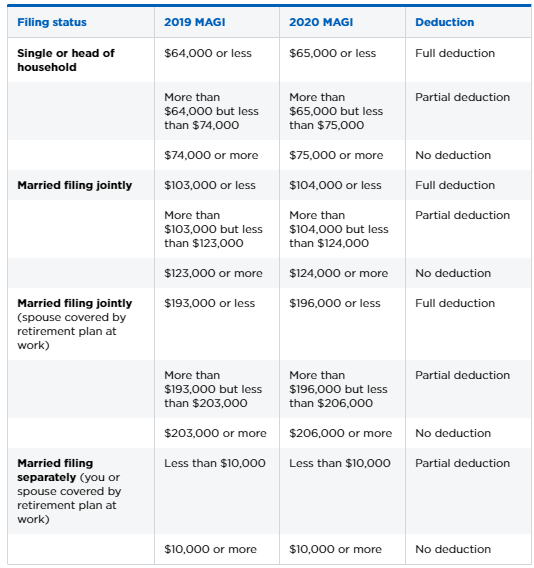

The amounts are much greater than the average 401k savings by age in America. A Roth IRA is an Individual Retirement Account to which you contribute after-tax dollars. Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds.

Before making a Roth IRA withdrawal keep in mind the following. Individuals will have to pay income. Earnings can be withdrawn tax-free and without penalties if the funds were in the Roth 401k for 5 years and youve reached age 59 12.

The Best 401k Companies If You Are Under 59 12. We stop at 65 because you are allowed to start withdrawing penalty free from your 401k at. Build Your Future With a Firm that has 85 Years of Investment Experience.

Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. While you still have to pay taxes on any money taken out of a 401k or IRA before a certain age there are some circumstances that. Direct contributions can be withdrawn tax-free and.

Roth 401k vs. Once that is done you can leave your current job before age. Contributions for a given tax year can be made to a Roth IRA up until taxes are filed in April of the next year.

You can get penalty-free access to plans from former employers if you roll them into your current 401k or 403b. Roth contribution withdrawals are generally tax- and penalty-free as long as the withdrawal occurs at least five years after the tax year in which you first made a Roth 401k. With a Roth IRA there.

In some cases its possible to withdraw from retirement accounts like 401ks and individual retirement accounts before your retirement age without a penalty. Roth IRA Distribution Details. Once you turn age 59 12 you can withdraw any.

See Roth IRA withdrawal rules. The IRS allows penalty-free withdrawals from retirement accounts after age 59 ½ and requires withdrawals after age 72. Build Your Future With a Firm that has 85 Years of Investment Experience.

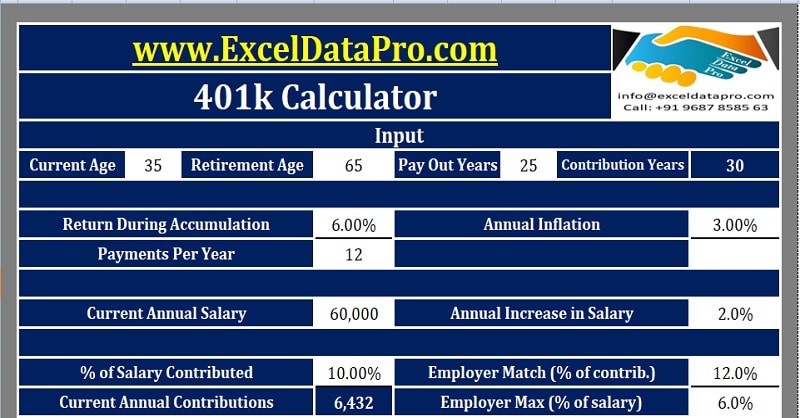

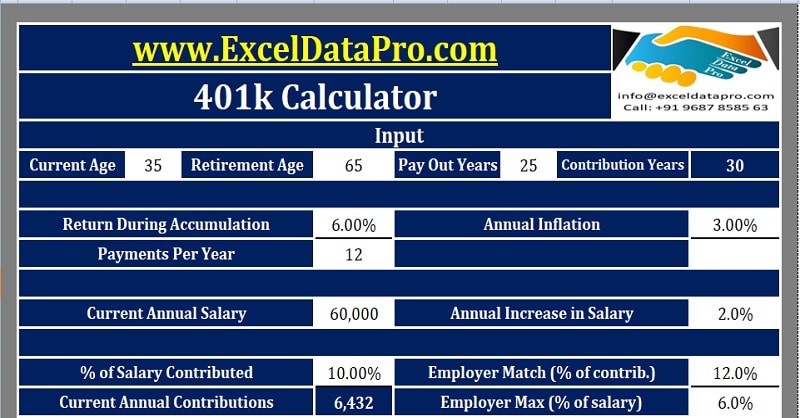

Free 401K calculator to plan and estimate a 401K balance and payout amount in retirement or help with early withdrawals or maximizing employer match. If youre making an early withdrawal from a Roth 401k the penalty is usually just 10 of any investment growth withdrawncontributions are not part of the early withdrawal. Making a withdrawal from your Fidelity 401k prior to age 60 should always be a last resortNot only will you pay tax.

Early withdrawal rules are very similar for both Roth 401ks and traditional 401ks. Roth 401k vs Roth IRA Both Roth 401ks and. You can avoid an early withdrawal penalty if you use the funds to pay unreimbursed medical expenses that are more than 75 of your adjusted gross income AGI.

You will still owe income taxes on the withdrawal although you can spread out the. 401k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator Print Use this calculator to estimate how much in taxes you could owe if you take a. If you qualify and take the withdrawal during 2020 then the 10 penalty for early withdrawal will be waived.

The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus. These are called required. Once you reach age 595 you may withdraw money from your 401k penalty-free.

If youre at least age 59½ and your Roth IRA has been open for at least five years you can withdraw money tax- and penalty-free. Pay taxes upon withdrawal. If you tap into it beforehand you may face a 10 penalty tax on the withdrawal in addition to.

Otherwise the outstanding loan balance is considered as a non-qualified early withdrawal subject to the 10 tax penalty. While there are no current-year tax benefits your contributions and earnings can grow tax-free and. Traditional 401k Withdrawal Rules.

Exceptions to the Early Withdrawal Penalty.

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Retirement Withdrawal Calculator For Excel

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

How To Calculate The Income Taxes On A 401 K Withdrawal Sapling

5 Legal Ways That Help You Reduce Federal Tax Liability Exceldatapro

/thinkstockphotos-152173891-5bfc353d46e0fb0051bfa959.jpg)

How To Calculate Early Withdrawal Penalties On A 401 K Account

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

401k Rollover Calculator To Roth Traditional Sep Or Simple Ira

How To Calculate Taxes Owed On Hardship Withdrawals 13 Steps

The Ultimate Roth 401 K Guide District Capital Management

401 K Retirement Calculator With Save Your Raise Feature

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

401k Calculator

Pin On Financial Independence App

How To Calculate Your Roth Ira And 401k Paychecks